From Energy Islands to Zero-carbon Hubs: The Geopolitical Game Map of Island battery storage Projects in Southeast Asian

Imagine an island: diesel generators are roaring, electricity bills are three times more expensive than those in big cities, and a typhoon can cut off power for a week. This was the norm in Cape Verde and Mauritius a few years ago.

Nowadays, with Chinese batteries, European loans and local wisdom, they are transforming themselves into “zero-carbon Island battery storage model rooms”.

In the unseen places, disputes over technical standards among China, the United States and Europe, the game between multilateral financing and sovereign funds, and the reorganization of regional alliances have transformed simple energy projects into political games.

But the covert competition among the major powers has turned this transformation into a thrilling game.

This article takes the Cape Verde and Mauritius projects as entry points to analyze the international competitive and cooperative logic behind Island battery storage.

I. The Dispute over technological sovereignty: A triangular Game among China, Europe and the United States

China: Full Industrial Chain Output and “Infrastructure Diplomacy”

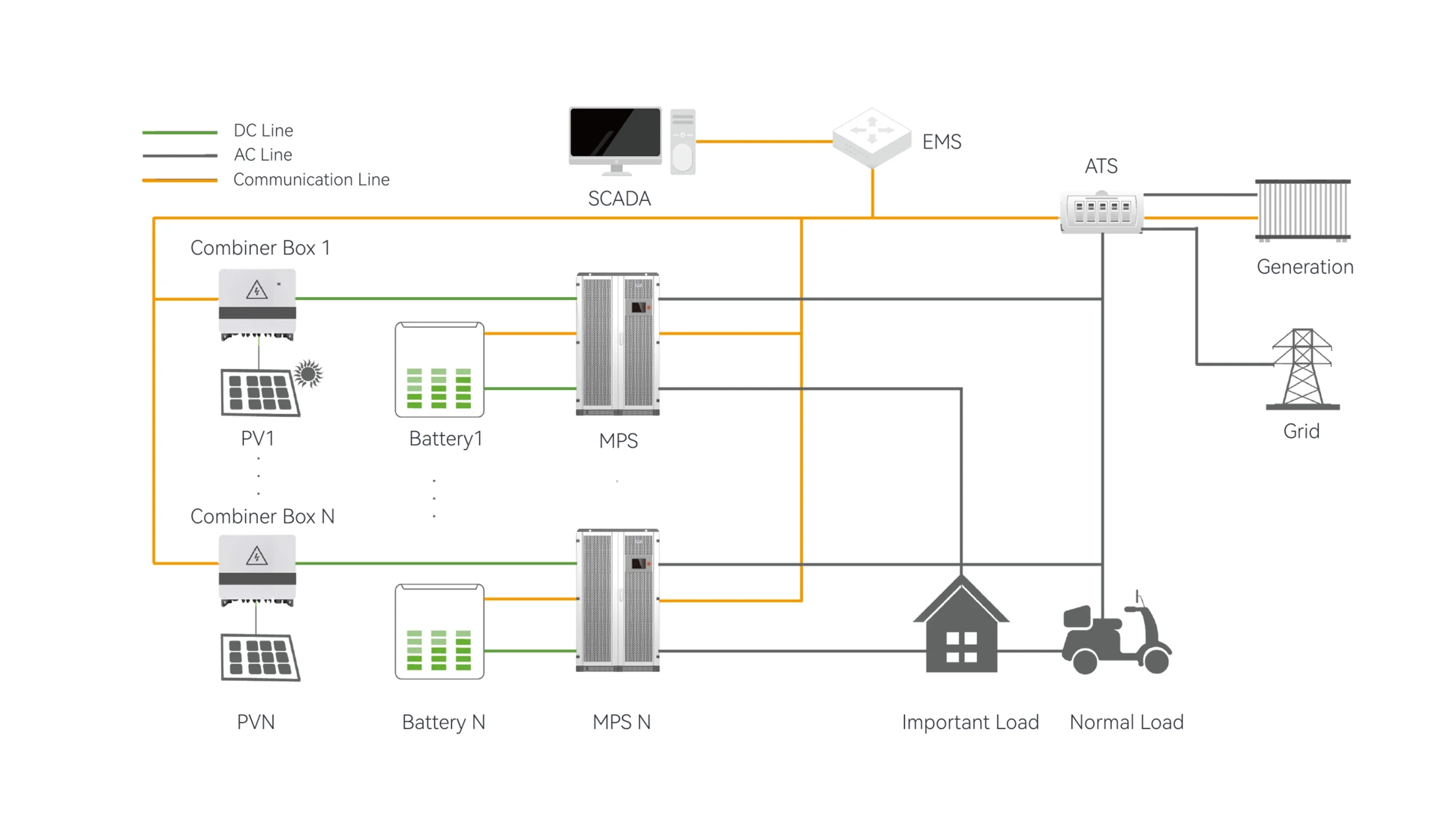

In the Mauritius Island battery storage project, Linyang Energy won the bid for a 40MW/120MWh grid-side energy storage system under the “EPC+ technology licensing” model. Its core advantages lie in: the anti-salt spray PACK and the four-level BMS architecture have solved the problem of high corrosion on the island, and it has passed the UL9540A:2025 certification. System-level control capability: It provides millisecond-level frequency response and black start function, replacing the stability role of traditional thermal power.

This model relies on the technology of private enterprises and the channel consortium of state-owned and central enterprises (such as Lin Yang’s cooperation with China Water Conservancy and Hydropower), and is rapidly replicated in places like Saudi Arabia and Indonesia, forming a standard toolkit for going global.

Europe and the United States: Multilateral financing is bound to standard discourse power

The Cabeolica Phase II project in Cape Verde has received a 19.6 million euro financing from the African Development Bank and the World Bank’s SEFA Fund, but with strict conditions attached: the equipment must comply with European grid standards (such as EN 50549), and the energy storage system must undertake auxiliary services such as frequency response;

The project is led by European Capital, with shares held by African financial companies and AP Moller Capital. The technical route is focused on liquid-cooled energy storage solutions in Europe and the United States.

To put it bluntly, the European conditions: We offer you a loan of 130 million, but you must purchase our equipment. Us threshold: Can I subsidize? The proportion of batteries made in the United States exceeds 50%

Game focus:

China has broken the deadlock with its cost and the speed of technological iteration. A Mauritius official privately quipped, “European equipment is as expensive as gold, but China’s after-sales response is fast – we are cutting prices on both sides!” Forcing Southeast Asian projects to take sides.

Ii. The Tricks Behind the Financing

Comparison of Three Major Investor Strategies

| Investor | Strategy | Experience for Island Nations |

| European Banks | Low-interest loans + Mandatory procuremen | Cheap but bundled sales (forced to buy specified equipment) |

| Chinese Funds | Turnkey projects + Rapid delivery | Cost/time efficient, yet debt risks concern |

| Singapore Consortiums | Singapore Consortiums | High autonomy, but higher profit sharing |

Investor Strategy Experience for Island Nations

European Banks Low-interest loans + Mandatory procurement Cheap but bundled sales (forced to buy specified equipment)

Chinese Funds Turnkey projects + Rapid delivery Cost/time efficient, yet debt risks concern

Singapore Consortiums Joint investment + Tech-sharing High autonomy, but higher profit sharing

True plot:

After accepting a European loan, Cape Verde found that it had to purchase German transformers at a high price.

Mauritius adopts China’s “pre-sale collection” model (similar to community group buying) to obtain battery payment in advance and pressure suppliers to lower prices.

Iii. Secret War of Rules: How Can Small Island Countries Use Chinese Batteries to Break Through European and American Standards

For a long time, Europe and the United States have dominated international technical standards (such as IEC certification), but China has broken through through practical operations in extreme environments: In the energy bidding project case of Mauritius, China’s Linyang Company installed anti-corrosion cabins and satellite links on the energy storage system, accumulated unique data on the high-temperature and high-salt island, and won the project with its hard power.

In Indonesia, Longi Photovoltaic bundled 4.4GWh of energy storage and recruited 85% of local workers to meet the policy, forcing European and American equipment manufacturers to follow suit and localize. For us, in the past, it was the European and American regions that set the rules and we followed them. Now, China directly uses the islands as the test ground – passing the test is the new standard!

Environmental protection Game: Clever Strategies for Attacking and Defending the Carbon Footprint Challenge

The EU is set to introduce a carbon tariff (CBAM) in 2025, requiring a clear account of the carbon footprint of batteries “from birth to recycling”. This is like a mysterious book for Southeast Asia, which lacks a accounting system.

In response to this, China’s solution is to package photovoltaic panels and energy storage into a “green energy package” in Mauritius. When generating electricity, the battery carbon emissions are automatically deducted, and the excess reduction volume is sold to European airlines. European enterprises jumped up and down: “This is cheating!” An official from the island nation chuckled, “Anyway, the electricity bill has been saved by 40%.”

Iv. Regional Alliance Reorganization: A Strategic Choice for Island Countries

The Philippines has launched a 9.4GW green energy auction, explicitly requiring a 1.1GW Island battery storage allocation project to be open for bidding by enterprises from China, Japan and Europe, using competitive bargaining (with the electricity price anchored at the upper limit of 0.18 US dollars per kWh). When conducting the public tender, they declared: “Come from China, Japan and Europe!” “Whoever has a cost per kilowatt-hour lower than 1.2 yuan will use it.” As a result, the electricity price was cut from 2 yuan to 1.1 yuan

Cape Verde accepts multilateral financing but retains equity. The government holds shares in Cabeolica SA to prevent the loss of energy sovereignty. Indonesia and Singapore are jointly building the Riau Green Industrial Zone, integrating photovoltaic manufacturing, energy storage and CCS technologies to create a “zero-carbon supply chain” across ASEAN.

Mauritius has positioned the Lin Yang energy storage system as a regional power grid hub and plans to export frequency regulation services to the island of Reina, upgrading it to an energy exchange node in the Indian Ocean. Mauritius’ “middleman” plan turns the Chinese energy storage system into an “Indian Ocean charging pile” : selling green electricity to passing cargo ships and renting frequency regulation services to neighboring islands.

Conclusion: The final Game – Who Dominates the Island’s energy nervous System?

The game of Island battery storage has gone beyond a simple technological competition and evolved into a dispute over energy governance models. Europe and the United States maintain their traditional influence through multilateral mechanisms and standard binding, but they face questions about costs and flexibility. In contrast, China has broken through by relying on the entire industrial chain and financial innovation, but it needs to deal with geopolitical risks.

While the major powers are quarrelling at the negotiating table, the island countries are making a comeback with three moves. The island countries are choosing to shift from passive recipients to rule participants. For instance, the mandatory energy storage allocation policy of the Philippines and the localization requirements of TKDN in Indonesia both demonstrate their awareness of energy sovereignty.

In the future, successful people need to balance three logics: technical economy, the cost per kilowatt-hour of electricity on the island, sovereign controllability (avoiding debt traps), and geographical compatibility (surviving flexibly in the competition among major powers). Cape Verde and Mauritius were precisely the leading experimental fields for this silent revolution, where players played against three or five chess players.

Find Your Solar + Battery Storage Specialist Now!

* Fill out this form and our experts will help you find the perfect solar storage solution for your home or business.