Industrial Solar Storage Cost 2025: Avoid 57% Loss & Secure 4-Year Payback

According to IRENA’s “Renewable Energy Cost Report 2025”: The global photovoltaic + energy storage comprehensive kWh cost has dropped to $0.036-$0.053/kWh (about 0.26-0.38 yuan/kWh), which is lower than the lower limit of coal-fired power costs ($0.044-$0.105/kWh). However, industrial and commercial energy storage has hidden risks—unplanned outage rate exceeds 57%, and only 20% of projects are profitable (Bloomberg New Energy Finance). This article will dismantle the cost structure, technology selection, and hedging strategy to help companies lock in 4-year payback.

1. Cost analysis: System price ≠ real cost, LCOE is the core indicator

| System scale | Energy storage capacity | Equipment cost | Integrated installation | Total cost | LCOE range |

|---|---|---|---|---|---|

| Small system | 50-200kWh | $160-200/kWh | 18% | $30k-80k | $0.42-0.77/kWh |

| Medium system | 500kWh-1MWh | $140-180/kWh | 15% | $150k-400k | $0.28-0.53/kWh |

| Large system | 1MWh+ | $120-150/kWh | 12% | $500k+ | $0.13-0.36/kWh |

Note: Integration includes EMS, grid access, and safety monitoring; data source: Wood Mackenzie energy storage cost model.

Hidden cost warning

- Safety compliance cost: Germany’s 2024 new regulations require more than 500 tests (such as AI arc detection), and the rectification cost of non-compliant projects reaches 23% of the total investment.

- Climate adaptability premium: Middle East projects require IP55 protection + liquid cooling (such as HighJoule HJ-40FT system), which is 12% more expensive than the standard solution, but can reduce the failure rate by 81%.

2. Technology life and death: Cycle life and intelligent scheduling determine success or failure

| Parameters | HighJoule LFP solution | Industry average LFP | Lead-acid battery |

|---|---|---|---|

| Cycle life | 15,000 times | 8,000 times | 2,000 times |

| Life cycle electricity cost | $0.0086/kWh | $0.017/kWh | $0.042/kWh |

| Temperature adaptability | -30°C~60°C | -20°C~50°C | 0°C~40°C |

Accelerated aging test of Gaogong Laboratory in 2024: Capacity retention rate after 15,000 cycles >92%

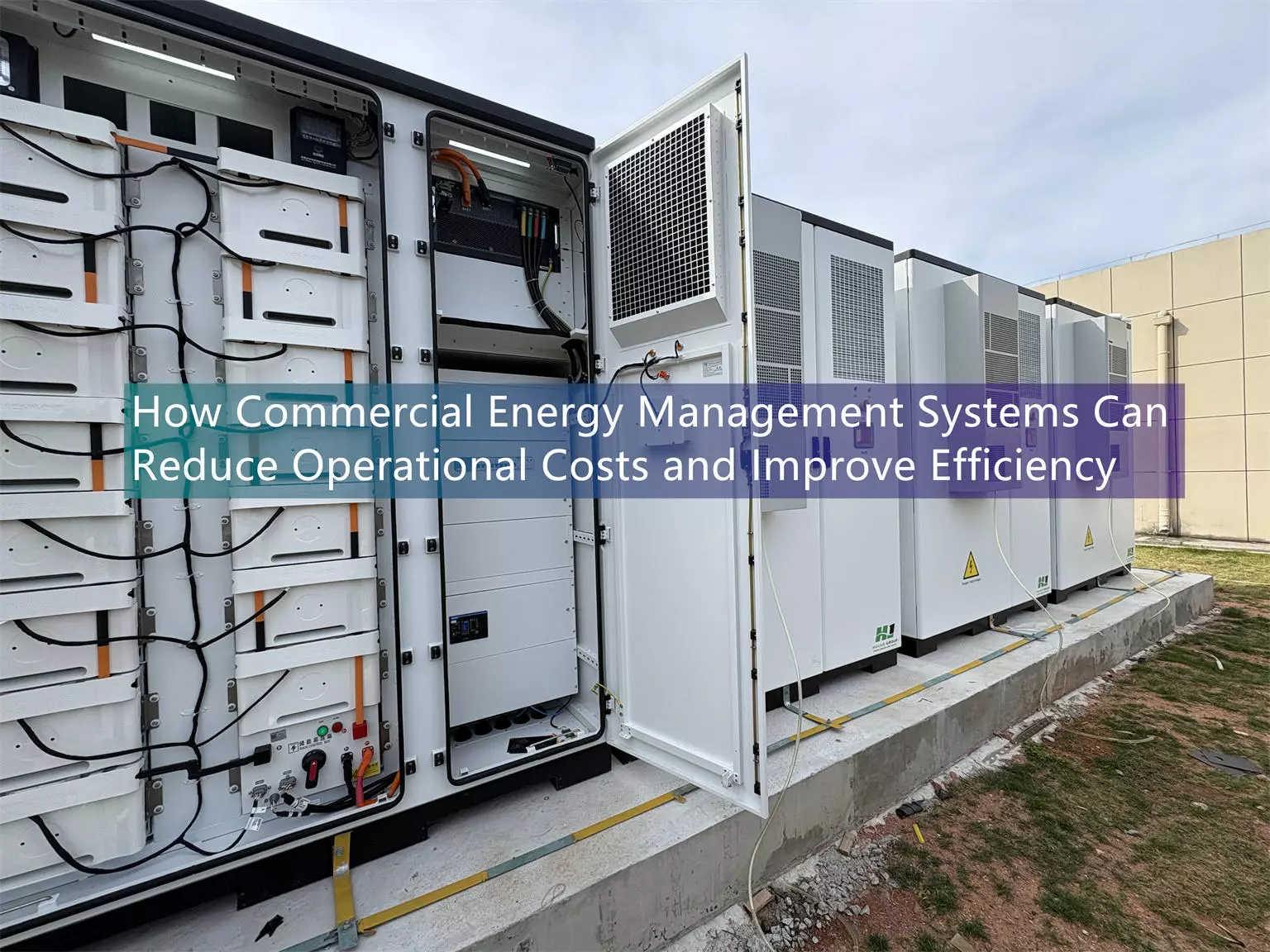

Intelligent scheduling: The core variable of 40% profit gap

- Passive energy storage: Only for backup power supply, ROI < 6%

- Active strategy (HighJoule SEM system):

- Electricity price arbitrage: Utilize the peak-valley price difference (e.g., California $0.25/kWh peak electricity vs $0.05/kWh valley electricity)

- Demand management: Reduce the peak load of Brazilian Electronics Factory by 1.2MW, saving ¥1.8 million in electricity bills annually

- Carbon trading gain: EU carbon price $75/ton, photovoltaic energy storage reduces carbon tax for export enterprises by 23%

3. Blood and tears case: Avoid the three major traps of industrial and commercial energy storage

Failure sample: A German machinery factory (2024)

Problem: Purchase low-priced battery cells ($0.07/Wh), with a cycle life of only 4,000 times

Consequence: After 2 years, the capacity decayed to 68%, and the maintenance cost exceeded the initial investment by 40%

Deep reason: Failed to pass the thermal runaway test of the new standard “GB/T 36276-2023”.

Successful example: Pilbara mining area in Western Australia (HighJoule solution)

| Indicators | Before transformation (diesel) | After transformation (photovoltaic + energy storage) | Reduction |

|---|---|---|---|

| Cost per kilowatt-hour | $0.48/kWh | $0.15/kWh | 68% |

| Diesel consumption | 1.2 million liters/year | 264,000 liters/year | 78% |

| Fault downtime | 23 days/year | 2 days/year | 91% |

Core measures: HJ-40FT liquid cooling system (IP55 protection) + AI scheduling algorithm adapted to sandstorm climate.

4. Selection guide: Four steps to lock in high-yield energy storage system

- Safety compliance first: Confirm that the system has passed the latest national/European standards (such as UL9540A, IEC62933).

- Cycle life verification: Require manufacturers to provide third-party test reports (>12,000 times is preferred).

- Intelligent strategy matching:

- High electricity price areas (such as California, Texas) → Focus on peak-valley arbitrage

- Weak power grid areas (mining areas, islands) → Strengthen black start capabilities

- Financial leverage maximization:

- US ITC tax credit 30% (until 2032)

- EU Innovation Fund subsidy 40%

5. Ultimate conclusion: 2025 is the golden window period for energy storage investment

“Every year of delay in deployment will result in a loss of ¥2.3 million/1MWh system” (calculated by Wood Mackenzie model).

Policy forced: EU Carbon Border Adjustment Mechanism (CBAM) imposes 23% tariff on imported products that do not use green electricity.

Cost inflection point: Energy storage cell prices hit bottom at $0.07/Wh in 2025, but low prices come with quality risks.

Technology mature: Smart scheduling can make the profit gap reach 40%.

Take action now:

Click to get HighJoule safe energy storage solution — 15,000 cycle life + AI scheduling system, has helped 37 projects around the world achieve return within 4 years.

Authoritative data sources:

- IRENA “Renewable Energy Generation Cost 2025”

- GB/T 36276-2023 Safety Requirements for Electrochemical Energy Storage Systems

- Bloomberg New Energy Finance “Industrial and Commercial Energy Storage Profitability Report”

The data in this article is as of Q2 2025, and the technical parameters are based on actual measurements in the HighJoule laboratory. Reprinting requires indicating the source.

Find Your Solar + Battery Storage Specialist Now!

* Fill out this form and our experts will help you find the perfect solar storage solution for your home or business.