Smart Grid Integration Costs in 2026: Interconnection Fees, Software, and Real Project Budgets

If you’re planning a microgrid or considering connecting an energy storage system to the grid for revenue generation, the first question you’ll likely face is: “What is the real cost of smart grid integration?”

“What’s this really going to cost?” That’s the first question I get, after twelve years of engineering solar and storage integrations. From a project engineer’s perspective, the real cost isn’t in the brochure. It’s in the details that determine your final P&L.

Understanding Smart Grid Integration Costs: Hardware, Software, and Interconnection Requirements

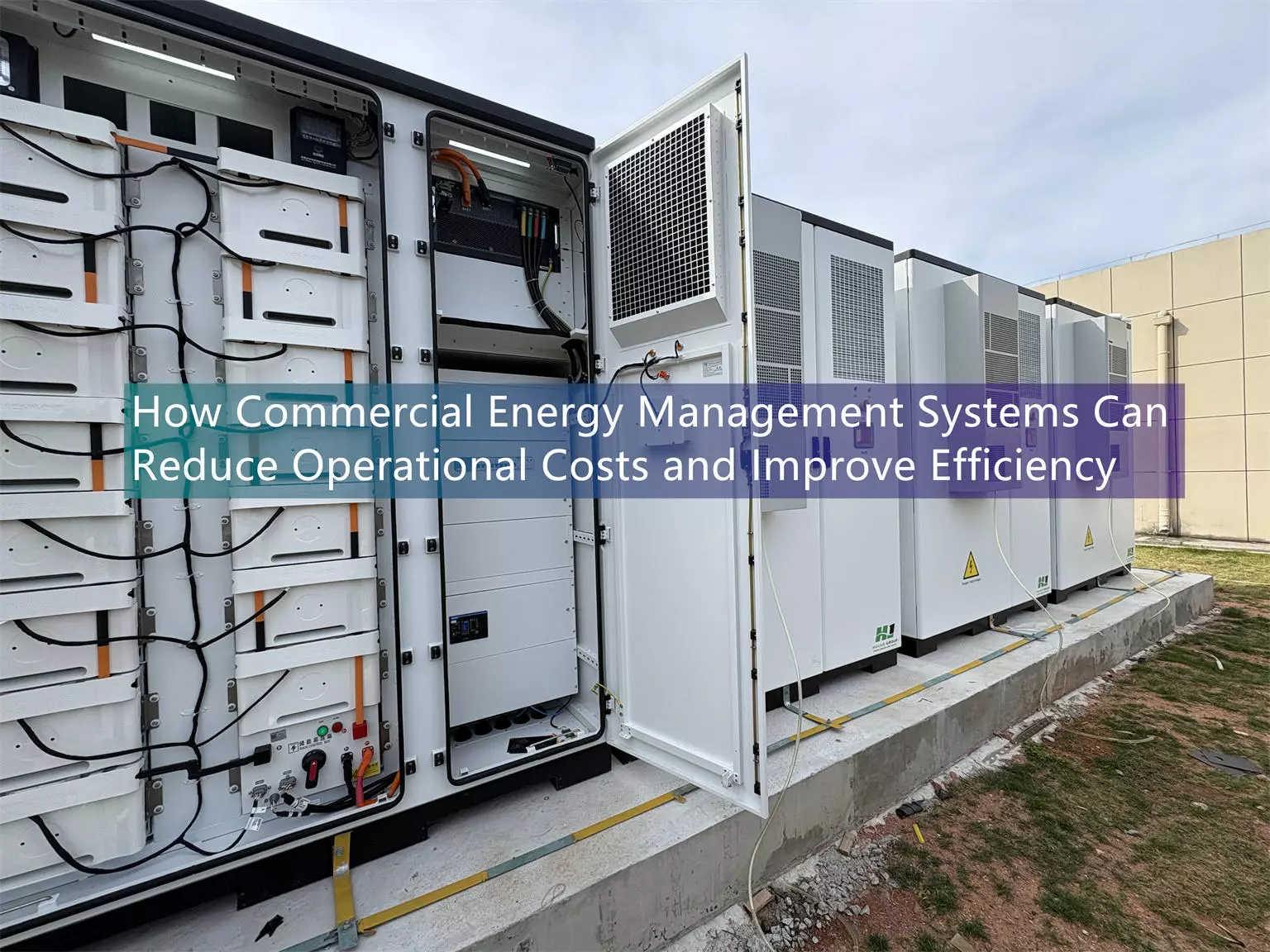

When clients receive an integration quote, they often assume that’s the total cost. However, the real cost consists of three layers: visible hardware, easily underestimated software, and the most unpredictable compliance-related and utility-driven costs.

1. CAPEX Breakdown: Hardware and Grid-Interactive Technology Cost

In my experience, hardware is the baseline, but the grid-interactive technology cost varies wildly based on local “Grid Codes.” For a recent automotive project in Germany, standard grid-following inverters weren’t enough. To comply with the latest VDE-AR-N 4110 dynamic stability requirements, we integrated Grid-Forming (GFM) inverters capable of providing synthetic inertia and grid-forming frequency response.

Utilizing pre-integrated, modular hardware—such as the HighJoule Smart Grid Solutions—can mitigate these risks. These systems are factory-tested for bidirectional power flow, preventing follow-on retrofit costs and late-stage on-site modifications.

2. Software & Logic Integration: The Underestimated “Project Brain”

“We already have a monitoring system; why do we need new software?” This is the question I’m most frequently asked.

The answer is simple: Traditional SCADA systems are designed for equipment protection, not dynamic grid dispatch. Last year, during a DER (Distributed Energy Resource) integration for an agricultural cooperative in California, software and logic integration accounted for nearly 30% of the total cost. This wasn’t just “buying an app”; it covered:

- AI-Driven Market Orchestration: Moving beyond basic APIs, we deployed machine learning models for real-time price forecasting and co-optimization across energy arbitrage and ancillary service markets (like FCR and aFRR).

- Advanced Algorithm Licensing: Moving beyond simple monitoring to active Frequency Regulation and AGC (Automatic Generation Control) requires specialized EMS (Energy Management System) logic.

- Complex Scenario Commissioning: Two weeks of on-site “handshake” testing between the software and hardware under simulated grid fault conditions.

Field Advice: If your goal is basic on-site consumption, software costs are negligible. However, if you intend to bid into electricity markets, budget $80,000 to $150,000 for the software platform and integration services on a typical mid-scale C&I project.

3. Compliance, Grid Studies, and Interconnection Fees: The Most Unpredictable Cost of Smart Grid Integration

This is the biggest variable in costs and highly dependent on the regional grid conditions. We compared three real-world projects:

| Project Location | System Type | Interconnection Application and Study Fees | Grid Upgrade Cost Share | Total Compliance Costs | Approval Time |

|---|---|---|---|---|---|

| Texas, USA | 500 kW Commercial Solar PV | Approx. $22,500 | $0 | Approx. $22,500 | 14 months |

| Tokyo, Japan | 1 MW Rooftop Solar PV | Approx. $39,500 | Covered by the grid company | Approx. $39,500 | 8 months |

| Queensland, Australia | 2 MW/4 MWh Energy Storage | Approx. $33,000 | $120,000 | Approx. $153,000 | 6 months |

Figures reflect actual interconnection invoices and grid study fees from completed projects;all costs are presented in USD for comparison purposes; local currency values were converted using average exchange rates applicable during the project execution period.

Key Insight: In areas with weak grids, grid upgrade cost sharing can exceed the hardware costs themselves. One hard lesson we’ve learned is that early informal technical discussions with the grid company are essential at the beginning of the project to obtain a preliminary assessment and avoid encountering “exorbitant” upgrade requirements later.

Project Case Studies: Two Contrasting Cost Stories

Case Study A: Cost Overrun at an Indiana Manufacturing Facility

Project: A manufacturing plant wanted to integrate 1.2 MW of solar PV and a new 800 kW/1.6 MWh energy storage system to save on electricity costs.

Initial Integration Estimate: $190,000. Final Realized Cost: $417,000 (119% over budget).

The “Death by a Thousand Cuts” Breakdown:

- System Strength Requirements: The utility mandated a synchronous condenser to mitigate low short-circuit levels—a $78,000 surprise that GFM inverters might have avoided if specified early.

- Cyber-Hardening: NERC CIP compliance and IT-mandated security audits added $32,000 in unbudgeted hardware and certification fees.

- Market Protocol Pivot: To meet PJM’s evolving fast-frequency response rules, we had to swap the control logic mid-stream, adding $57,000 in engineering hours.

Lesson Learned: The initial quote reflected only the physical connection cost, not the full cost to integrate with the smart grid under actual utility, cybersecurity, and market operation requirements.

Case Study B: Controlled Integration Costs in a Spanish Residential Community

Project: A residential community in Seville, integrating 580 kW of shared solar power and community battery storage.

Key to Successful Cost Control:

- Early Collaboration: The regional utility provider and Spanish regulatory authorities were involved from the design phase.

- Deployment of Pre-certified Grid-Forming Solutions: We utilized an integrated system pre-certified for Grid-Forming (GFM) capabilities by the Spanish grid operator (REE). By selecting HighJoule’s pre-integrated BESS stacks, which already meet the 2026 EU Network Code on Demand Connection, we eliminated the need for bespoke system-strength studies. This approach reduced on-site commissioning time by 40% and avoided costly dynamic model validation fees.

- Utilization of Policy Templates: The local government provided a standardized interconnection application package, reducing legal consulting fees.

Result: The total cost was only 9% higher than the budget.

How to Accurately Estimate Your Project Costs? A Four-Step Framework

Based on experience from hundreds of projects, I have summarized this four-step estimation method:

- Classification: Clearly define your “grid interaction level.” Is it only feeding power (Level 1), accepting simple commands (Level 2), or participating in the electricity market (Level 3)? The level directly determines the technology selection and cost baseline.

- Three-Party Quotations: Be sure to obtain ① hardware quotations from equipment manufacturers, ② engineering and software quotations from integrators, and ③ written preliminary interconnection requirements and fee schedules from the grid company.

- Include “Hidden Factors”: Add a risk factor to the total hardware + software cost based on the project location: 15-25% for mature regulatory areas (such as California, Germany); 35-50% for emerging markets or areas with weak grids.

- Calculate Long-Term Costs: Clarify annual software license fees, maintenance contracts, data service fees, and other long-term operating costs.

The Other Side of Investment: Where Do the Returns Come From? When discussing costs, returns must also be considered. Taking our Minnesota food cold storage project as an example:

- Integrated investment: $223,000 (upgrading existing energy storage to grid-interactive).

- Annualized return:

- Demand charge savings: $48,000 annually through precise peak shaving.

- Frequency regulation service revenue: $31,000 annually from participating in the Midcontinent ISO market.

- Reliability value: Avoiding production losses due to a single voltage drop, approximately $20,000 (achieved in the first year).

- Payback period: 223,000 / (48,000 + 31,000 + 20,000) ≈ 2.2 years.

(Note: Returns are highly dependent on local market rules and require specific analysis.)

Summary and Key Recommendations

Smart grid integration costs are a dynamic system engineering challenge. The key to success lies in adopting a “total cost of ownership” perspective, rather than focusing solely on equipment unit prices.(Some integration challenges only become visible once the system is energized and operating under real grid conditions.)

Your final checklist:

- Have you received written preliminary interconnection requirements from the utility company? (This is the most important first step)

- Does your budget include system impact studies, potential grid upgrades, and annual compliance costs?

- Does the selected equipment have successful grid connection case studies in your local area? Or is it a “first of its kind”?

- Can the software platform adapt to new markets or services that may be available in the future?

- Have you discussed the timeline for revenue realization and operating costs with your finance team?

- Does your system hardware include a digital battery passport to comply with international supply chain transparency and recycling regulations?

As technology advances, hardware costs are decreasing, but the complexity of software and compliance is increasing. Choosing modular, pre-certified solutions and conducting early, in-depth planning is key to transforming integration costs from a “burden” into long-term competitiveness and cash flow. On the path to energy transition, a clear understanding of costs is the first cornerstone to ensuring that every investment is impactful.

Find Your Solar + Battery Storage Specialist Now!

* Fill out this form and our experts will help you find the perfect solar storage solution for your home or business.